Central Bank Of Canada Cbdc

Threats must be mitigated to protect the integrity of funds and the confidentiality of users. In a staff paper published Tuesday the Bank of Canada has laid out a positive case for CBDC adoption.

Central Banks Set Out Ground Rules For Digital Currencies Nfcw

The Bank of Canada has been actively investigating designs use cases models and policy questions around the creation of a Central Bank Digital Currency CBDC.

Central bank of canada cbdc. After years of research the Bank of Canada is preparing to design its own central bank digital currency CDBC. Security must permeate the design of a CBDC. Additionally the paper explores several ways smart contract.

Canadas central bank seems much eager toward adoption of blockchain technology. Canada Explores CBDC Benefits Canadas central bank appears to be bullish on CBDCs. An interest-bearing and universally accessible central bank digital currency CBDC could be a versatile instrument that would in theory improve monetary policy by allowing non-linear transfers and more direct implementation and transmission.

In a staff paper published Tuesday the Bank of Canada has laid out a positive case for CBDC adoption. The Bank has established two external engagement groups. The news came to light after the release of an internal presentation given in September last year to the banks board of directors.

A secure CBDC system will retain public trust in the central bank. A CBDC could be an effective competition policy tool for payments. It can still be used in a wider range of transactions despite its declining use by Canadians.

Increased competition amongst payment service providers and digital innovation. It could help solve market failures and foster competition and innovation in new digital payments markets. Central bank cash supports all of these features and public policy objectives.

These risks arise from how balances are aggregated from their transactional use and from the competition between suppliers of aggregation solutions the report. According to the Canadian central bank report the risks of CBDCs basically revolve around accumulated balances. Operational security would be ensured through continuous testing.

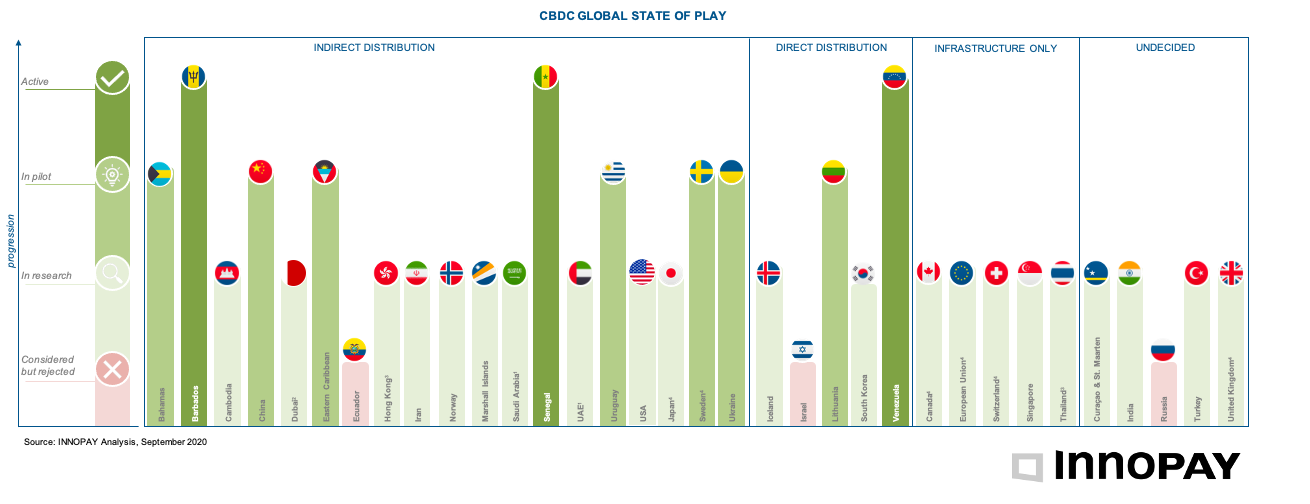

A CBDC could also support the vibrancy of the digital economy. Stake your points and qualify for the 200000 USDT prize pool. A group of seven central banks Bank of Canada Bank of England Bank of Japan European Central Bank Federal Reserve Sveriges Riksbank and Swiss National Bank together with the Bank for International Settlements are working together to explore central bank digital currencies CBDCs for the public general purpose or retail CBDC.

The central bank of Canada released their draft paper about the adoption of Central Bank Digital Currency and explained their many beneficial facts to use. The CBDC Engagement Forum chaired jointly with HM Treasury will engage senior stakeholders and gather strategic input on all non-technology aspects of CBDC. The authors of the paper outline several potential benefits such as promoting competition in the financial sector and improving consumer choice.

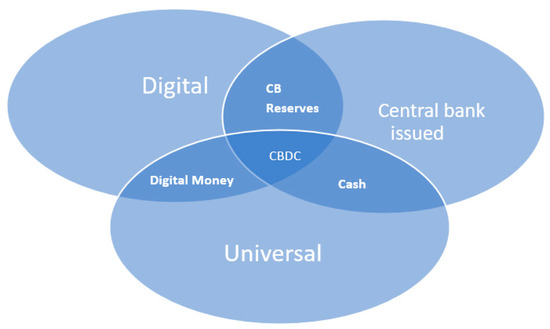

Central bank digital currency CBDC entral banking digital currency c digital money distributed ledger technology blockchain. The views expressed here are those of the authors and do not necessarily reflect those of the Bank for International Settlements. Given its physical nature cash.

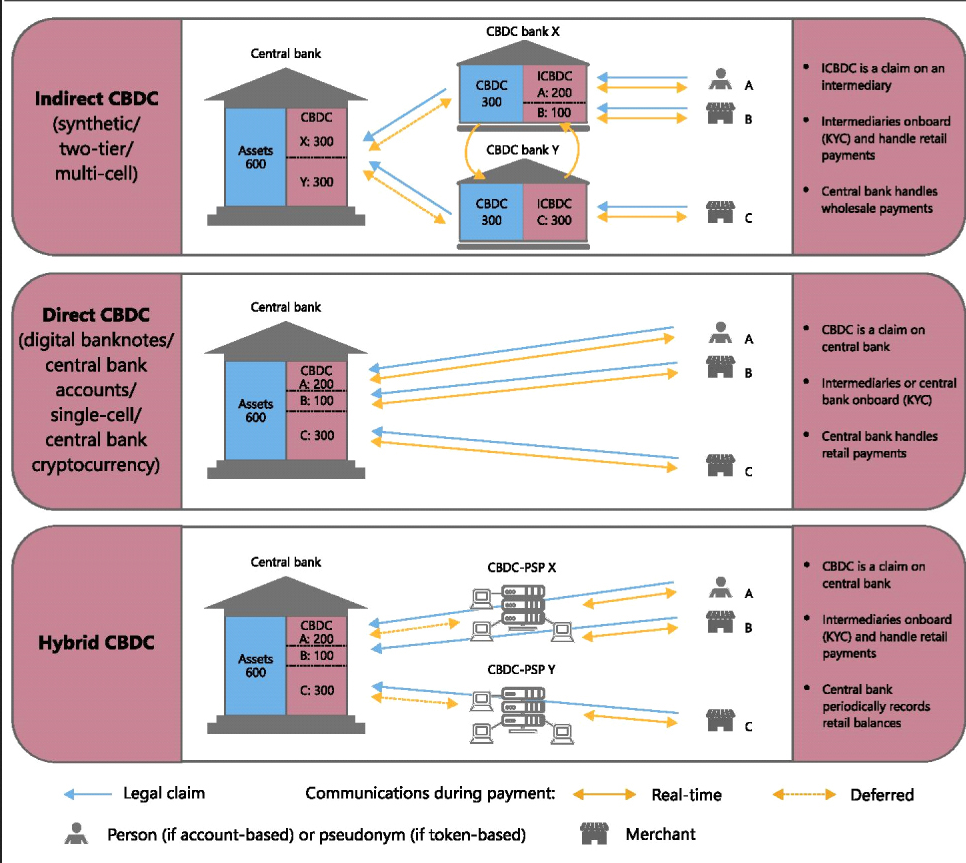

Overall competitive and innovative advantages are supporting arguments for issuing a CBDC. Accounts held at intermediaries could allow for convertibility between CBDC and commercial bank deposits and create an open-loop payments system. The Bank of Canada BoC has addressed arguments for a central bank digital currency CBDC in a discussion paper.

Building on an initial report outlining foundational principles for CBDCs published in 2020 the group formed by Bank of Canada Bank of England Bank of Japan European Central Bank Federal Reserve Sveriges Riksbank Swiss National Bank and BIS has now turned to practical policy and implementation issues. It argues that a CBDC is probably necessary to support the development of the digital economy. The authors of the paper outline several potential benefits such as promoting competition in the financial sector and improving consumer choice.

Canadas central bank appears to be bullish on CBDCs. The Bank of Canada Expects To Boom With CBDC. Bank of Canada.

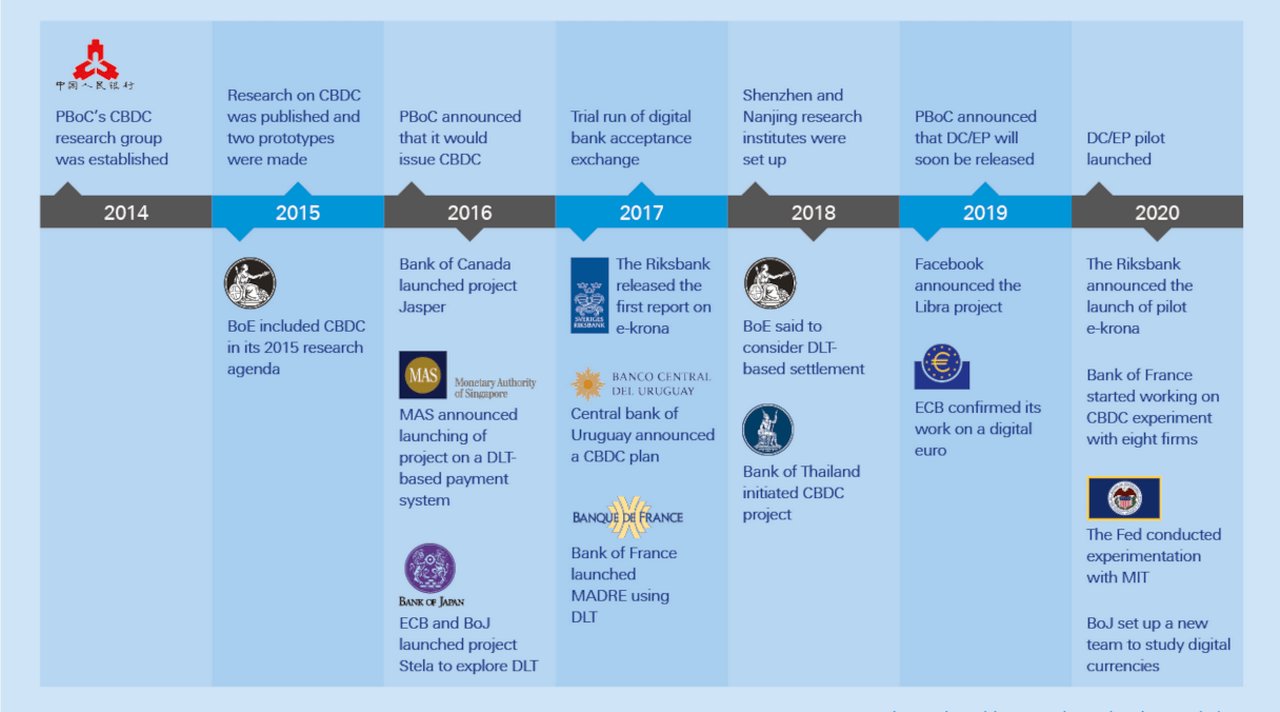

Distinct CBDC approaches by the central banks of China Sweden and Canada. Yesterday the Financial Post reported that the Bank of Canada has been working on a public central bank digital currency CBDC to replace cash. 1 To solicit additional ideas the Bank initiated the Model X Challenge in which it invited three independent university-based project teams to conduct exploratory design work on a CBDC in Canada.

The authors of the paper outline several potential benefits such as promoting competition in the financial sector and improving consumer choice. Revealing its plans in a June 11 job posting the central bank. As reported by BTCManager back in February 2020 a senior executive stated that the BoC will develop a digital Canadian dollar only when it is absolutely necessary.

In a staff paper published Tuesday the Bank of Canada has laid out a positive case for CBDC adoption. While none of these central banks has yet decided to proceed with a retail CBDC. The participating universities were.

Cash is the only truly anonymous payment instrument in the sense that it allows Canadians to make purchases without sharing any personal information. The Trust Project is an. These expected benefits however might be small or are unlikely to be realized in practice.

Additionally the paper explores several ways smart contract. The Bank of Canada European Central Bank Bank of Japan Sveriges Riksbank Swiss National Bank Bank of England Board of Governors of the Federal. The Banks Deputy Governer committed to making their CBDC greener than bitcoin Currently bitcoin mining uses more energy worldwide each year than the Netherlands.

To evolve and pursue their public policy objectives in a digital world central banks are actively researching the pros and cons of offering a digital currency to the public a general purpose central bank digital currency CBDC. Canada exploring consumer CBDC to replace cash. Yesterday the Bank of Canada published a report discussing the key motivations for a central bank digital currency CBDC.

The CBDC Technology Forum will engage stakeholders and gather input on all technology aspects of CBDC. An anonymous token-based central bank digital currency CBDC would pose certain security risks to users. Canada Explores CBDC Benefits Canadas central bank appears to be bullish on CBDCs.

With the various researches carried out by the Bank of Canada the central bank is however in no hurry to issue a CBDC. The paper detailed the primary benefits of developing a Canadian digital dollar. As a liability of the central bank with the full backing of the government central bank cash is the safest form of money.

Security must be engineered from inception for all use cases of a CBDC should the Bank of Canada choose to issue one. The Bank of Canada is continuing to push toward the release of a central bank digital currency. The authors identified two primary triggers for issuing a CBDC.

We discuss the competition and innovation arguments for issuing a central bank digital currency CBDC. If CBDC accounts were held at financial institutions and other distributors they would likely require fiduciary separation of central bank funds and commercial bank deposits within accounts. CBDC Engagement Forum and CBDC Technology Forum.

List Of Banks In Lebanon With Their Official Information In 2021 Financial Organization Lebanon Central Bank

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Bank Of Thailand Enters Third Phase Of Cbdc Development Now Using Cbdc With Big Businesses Climate Change Skyline Big Business

Central Bank Digital Currencies The Game Changers Deutsche Bank

What Is Digital Central Bank Currency Cbdc Unwomen Nc

Coronavirus Accelerates The Central Bank Digital Currencies Cbdc Process Somag News

Pandemic Accelerates Bank Of Canada S Cbdc Work

Central Banks Board Members To Discuss Ways Of Better Using Blockchain In Cbdc Rollout Btcmanager Blockchain Central Bank Emerging Technology

Central Bank Digital Currency Cbdc Is Not A Cryptocurrency By Jagdish Klever News

Joitmc Free Full Text Central Banks Digital Currency Detection Of Optimal Countries For The Implementation Of A Cbdc And The Implication For Payment Industry Open Innovation Html

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Cbdcs Archives Schnapper Casteras Pllc

No Single Digital Currency Will Dominate The World Bank Of Japan Now Says Bank Of Japan Trading Bank For International Settlements

Central Bank Digital Currencies Today S Buzzword Or Time To Get Ready Innopay

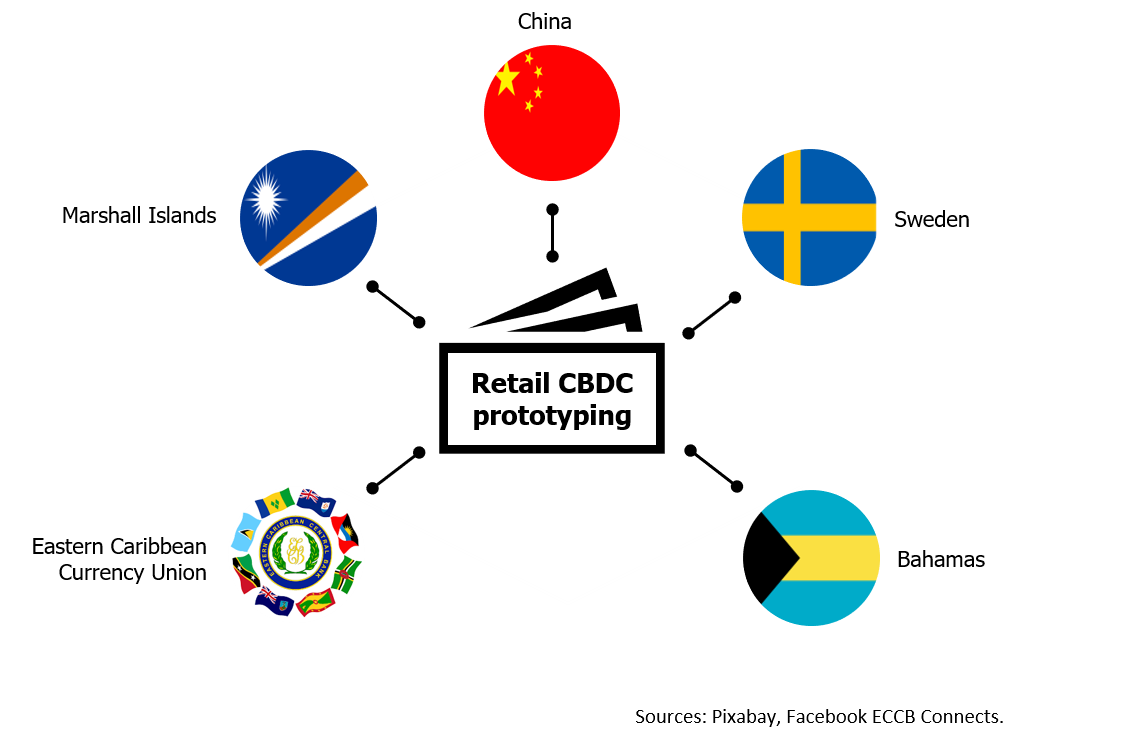

Cbdc Pioneers Which Countries Are Currently Testing A Retail Central Bank Digital Currency By Jonas Gross Medium

Central Bank Digital Currency Cbdc In Depth Guide